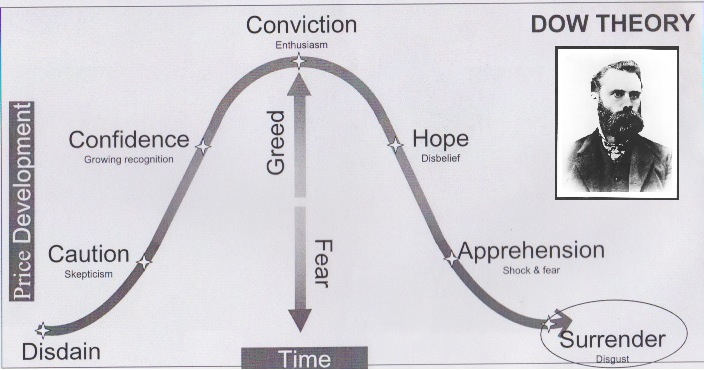

A form of technical analysis from the 1800s by Charles Dow. There are 6 parts to this theory. Theory basically tries to answer “how does a market feel about an asset?”

1. Markets have Three types of MovementsMain Movement – long term outlook (time frame – a year or more)

Medium Swings – price changes (time frame – 10 days to 3 months)

Short Swings – how the asset is behaving hour to hour? (time frame – an hour)

2. Markets have Three Major PhasesAccumulation Phase – investors in the know are purchasing an asset before the market catches on

Absorption Phase – rapid price changes as the larger public starts to participate

Distribution Phase – early investors begin to sell off their holdings

3. Markets discounts all news, any news is quickly reflected (sum of the worlds hope, fear, projection and history are taken into account)4. Averages in the market must confirm each other (for example - solar stock vs. solar panels stock, both should move together)5. Volume confirms trends6. Trends exist until they definitely don't, when does one start and one end? (so err on the side of the long term pattern)These six basic tenets of Dow theory were summarized by W. Peter Hamilton, Robert Rhea, and E. George Schaefer

wellbutrin 100mg tablets

buy prozac india

misoprostol where to buy

lotrisone prescription

acyclovir cream coupon

clopidogrel buy online

metformin price in mexico

2.5 mg cialis daily

where to buy celebrex

levitra 20 mg tablets price

vardenafil 10 mg

online pharmacy australia paypal

propecia nz price

dapoxetine mexico